Billion dollar weather events impacting insurance costs

Mitigating Weather and Climate Risks with Comprehensive Property Insurance

In an era of escalating climate volatility, the necessity for comprehensive property insurance has never been more pronounced. The unprecedented weather and climate-related disasters of 2023 have underscored the critical role of homeowners and business insurance in mitigating climate risks, managing damage expenses, and preparing for the unexpected.

Unleashing the Fury: A Recap of 2023’s Unprecedented Weather Events

In a sobering depiction of our shifting climate, 2023 saw a staggering surge in billion-dollar weather and climate disasters across the United States. From scorching heatwaves to devastating floods, these events wreaked havoc on communities, emphasizing the importance of safeguarding properties with robust insurance policies.

Record-Breaking Heatwaves

July 2023 was particularly brutal, with record-high temperatures scorching much of the Southwest. Arizona and New Mexico experienced their hottest month ever, with temperatures in Phoenix, Arizona, reaching an average of 102.8 degrees Fahrenheit, the hottest month recorded for any U.S. city.

Devastating Floods

Torrential downpours led to catastrophic flooding in several Northeast communities. In Vermont’s capital, Montpelier, residents grappled with over five inches of rainfall within 24 hours, causing widespread flooding and damage.

Severe Storms

On top of the heatwaves and flooding, severe storms brought further destruction. In July alone, an extreme thunderstorm outbreak in Alaska resulted in more than 19,000 lightning strikes, igniting dozens of wildfires.

The Economic Toll: A Snapshot of the Financial Fallout

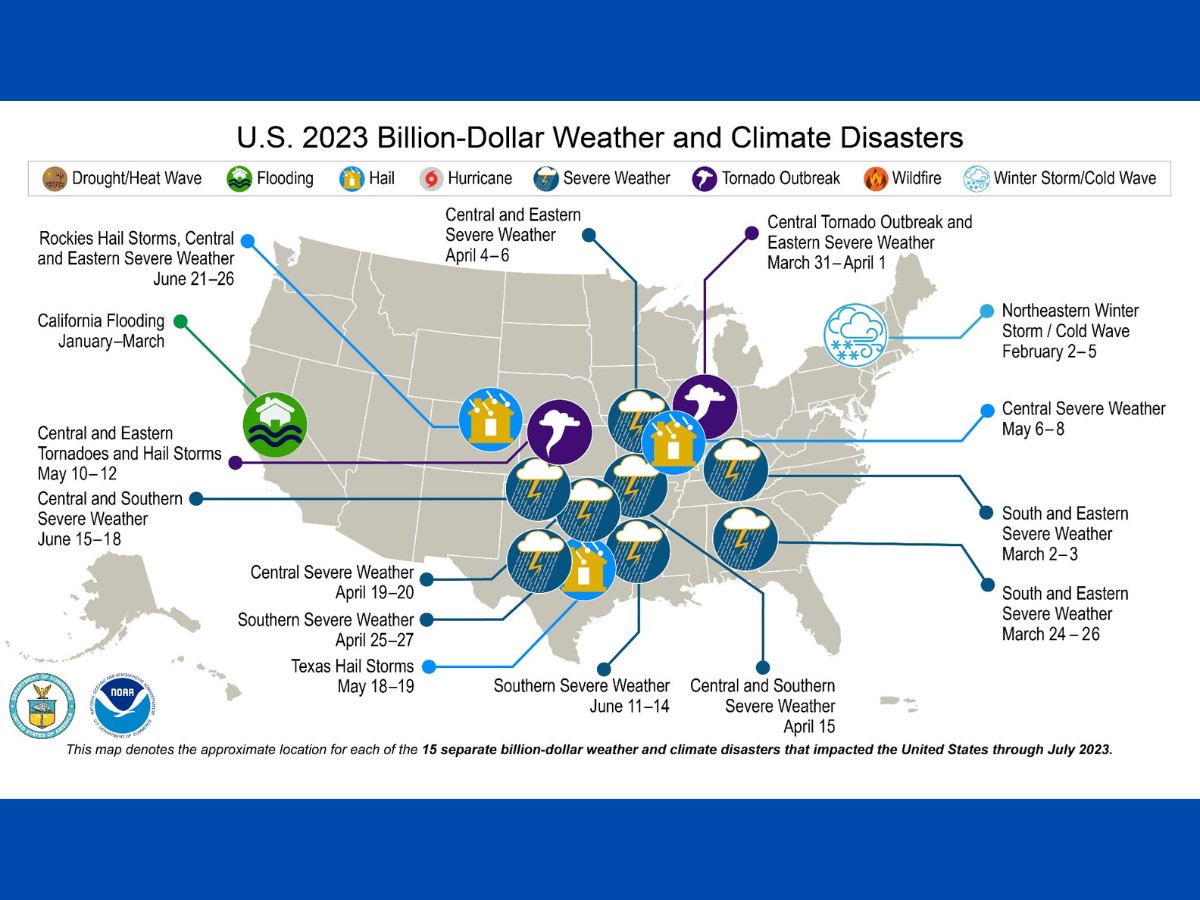

The financial fallout from these disasters was equally staggering. From January to July 2023, the U.S. sustained 15 separate weather and climate disaster events, each causing losses exceeding $1 billion. This marks the highest number of billion-dollar disasters ever recorded for the first seven months of any year since tracking began in 1980.

These events resulted in 113 direct and indirect fatalities and caused more than $39.7 billion in damages, adjusted to the Consumer Price Index (CPI) for 2023.

In the face of these escalating weather and climate risks, property insurance has emerged as a crucial tool for homeowners and businesses alike. By covering damage expenses and helping the insured prepare for the unexpected, property insurance offers a vital layer of financial protection and peace of mind.

Homeowners Insurance: Safeguarding Personal Properties

For homeowners, insurance policies are a key defense against weather-related damages. From covering repair costs after a severe storm to providing temporary living expenses if a home becomes uninhabitable due to flooding, homeowners insurance provides a safety net for individuals and families navigating the aftermath of a weather disaster.

Business Insurance: Protecting Commercial Interests

For businesses, insurance is equally important. Commercial property insurance can cover damages to business properties, while business interruption insurance can help recoup lost income during the recovery period. In the wake of 2023’s disasters, these coverage options have proven invaluable for businesses working to bounce back.

Decreasing Risk and Protecting Property: The Role of Insurance in Climate Resilience

While insurance can provide financial relief after a disaster, it also plays a pivotal role in fostering climate resilience. By encouraging policyholders to implement climate-smart practices and improvements, insurance can help decrease risk and increase property protection.

Encouraging Risk Mitigation Measures

Many insurance companies offer incentives for policyholders to implement risk mitigation measures. For example, homeowners may receive discounts for installing hurricane shutters or reinforcing roofs, while businesses might qualify for lower premiums by implementing flood-proofing measures.

Driving Climate-Smart Investments

Insurance can also drive investment in climate-smart infrastructure and technology. By factoring climate risks into pricing and underwriting decisions, insurers can encourage the adoption of climate-resilient building practices and sustainability-focused technologies.

Navigating the New Climate Reality with Insurance

As the destructive events of 2023 have illustrated, the climate crisis is no longer a distant threat but an immediate reality. In this new climate landscape, comprehensive property insurance is more than just a financial safeguard—it’s a critical tool for resilience, risk mitigation, and preparedness. As we confront an era of escalating weather and climate risks, insurance offers a way to protect our properties, our finances, and our future.

In a world where weather disasters and climate risks are increasingly the norm rather than the exception, the importance of property insurance has never been more apparent. Whether you’re a homeowner or a business owner, insurance can help decrease risk, manage damage expenses, and prepare you for the unexpected. With the right insurance policy, you can weather any storm and protect your property in the face of our changing climate.